Platform Finance experiences 100% increase in this category

Personal lending has skyrocketed since the pandemic began – with home improvements and debt consolidation driving the demand. And that growth is set to continue, as Platform has experienced almost 100 per cent growth in personal loans in the first quarter of FY22 compared with the same period in FY21.

Damian Mantini, Director Aggregation and Strategic Partnerships, says there has been a “trio” of key drivers behind the surge:

“Firstly, the pandemic has allowed people to review their current situations and it’s led to an increase in home renovations/enhancements and debt consolidation; secondly, funders’ appetites for personal loans have grown; and, thirdly, interest rates have fallen for those with strong credit profiles, which enables greater flexibility.”

CEO Ryan Young says,

“These products are not there to put financial stress on the customer, it’s about assisting them. Personal loans are a great alternative and there are many instances where they are easier than a secured asset loan for certain asset types and also a better option than, say, a buy now pay later product or using your credit card.”

Mantini adds,

“the stigma around personal lending has broken”. “Before the pandemic, there were negative perceptions around this sector, but there’s been a major transformation and personal lending is now increasingly commonplace.”

Rapid Growth

The demand for personal loans has exceptionally accelerated over the past 12-14 months. As international travel became near impossible, attentions shifted to renovating homes and paying off debt.

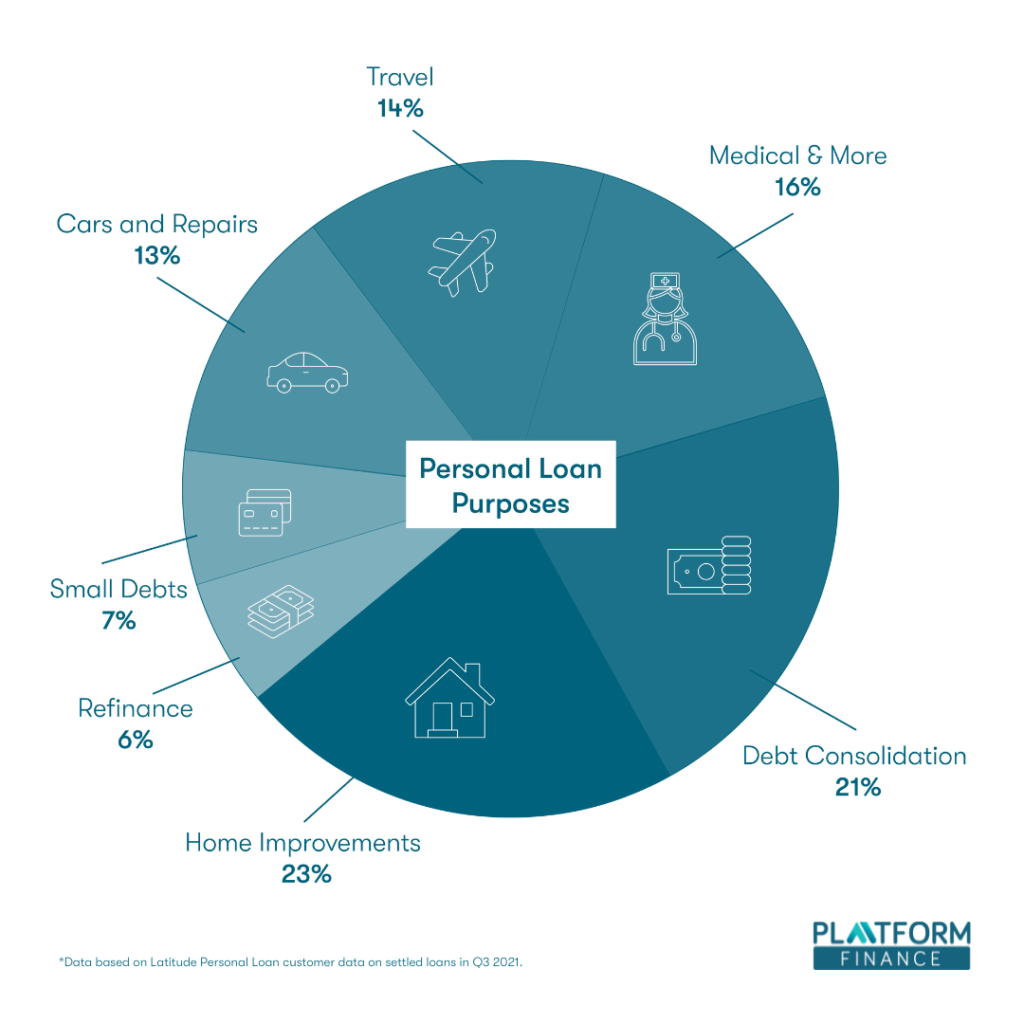

According to figures from Latitude, home improvements and furnishings accounted for 23 per cent of all personal loans, while debt consolidation was 21 per cent.

Mantini says that,

“We’ve witnessed the boom in housing mortgages and there has been a concurrent growth in home renovations and improvements.”

Greater diversity

We now have six lenders on our personal finance panel including:

“Funding diversity is crucial; it’s vital to have choice to meet customers’ needs. We’re catering for brokers at all levels – from those who are new to the personal lending space to those who specialise in it or are able to add it as a value-add for their customers.”

Young says; also predicting that personal lending growth is likely to continue – even beyond the opening of Australia’s borders and as people begin to travel.

“This sector will continue to grow in the short to medium term.”

“The significant fall in rates for prime borrowers will open up a whole new pool of customers for our brokers. In addition, supply chains are so stretched, which means there’s a delay in getting goods and services. There’s still a lot of pent-up demand.”

For more information on the range of Personal Loan products that Platform can assist brokers with, contact us today.